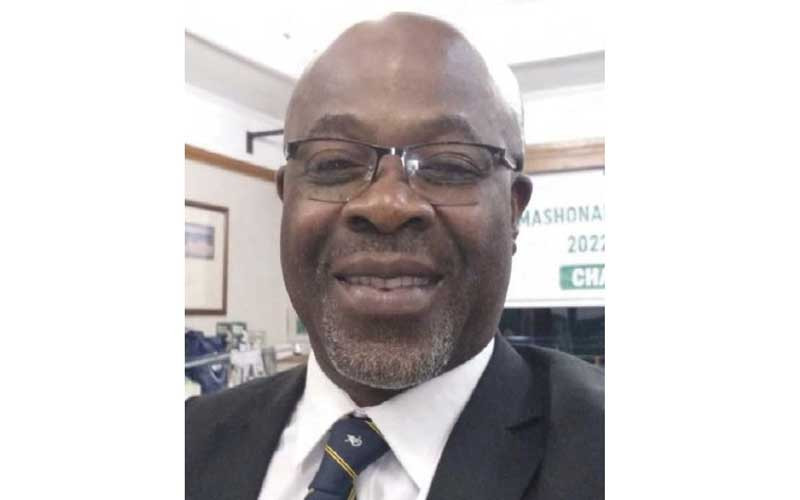

NATIONAL Railways of Zimbabwe (NRZ) general manager Lewis Mukwada (LM) was recently appointed president of the Southern Africa Railways Association (Sara) for the 2018–2019 period. NewsDay (ND) business reporter Mthandazo Nyoni interviewed Mukwada, who speaks on Sara and challenges faced by the railways sector in the region. Find excerpts of the interview below:

Business Interview: MTHANDAZO NYONI

ND: Congratulations on your election as Sara president. Can you briefly tell us more about Sara and its purpose?

LM: Thank you. Sara is a regional body of railways in the region. It was formed in 1996. At the time it was formed, it was more like an advocacy body for lobbying policies, but as time went on, it developed into one that could co-ordinate regional strategies and set up goals so that the regional railways could develop. So it comprises most of the railways in the region, they are members. Apart from that, we also have members who are not strictly railway operators, but who are aligned to the railways like some of the companies in the logistics sectors. Some of the suppliers in the railways industry also joined that grouping.

ND: As the new Sara president, what plans do you have for the association, say in the short, medium and long-term?

LM: Last year, as Sara, we sat down and came up with a five-strategic plan that set to drive forth the Sara agenda so that at least we have some key deliverables over the five-year period and some of these include increase in market share. You will note that we have lost quite a lot in terms of market share to road. I think the estimates indicate that only 13% to 15% of the regional service transport is rail, the rest is road. So one of the goals is to reclaim that market share and our target is to reclaim something like 40% over the five-year period. We realise that as individual railways, while we are making our efforts, initiatives and so on, we stand a better chance if we worked together as a group.

What we have been emphasising is a corridor approach to dealing with our customers. You know that for road, for example, a truck leaves the Democratic Republic of Congo (DRC) goes all the way to South Africa. Just one truck and you deal with one supplier of a service. For railways, you start with a Société Nationale des Chemins de Fer du Congo (SNCC) which is the railways in the DRC, Zambia Railways, Zimbabwe’s NRZ, BBR, and then Transnet before you get to the port. As such, it’s very difficult for customers because they sometimes have to negotiate rates or the tariff for each railways, add them and then compare with road.

So, we are really trying to emphasise the regional approach. In terms of marketing, we are trying to market our service as a corridor so that we can give the customer one tariff. I think you recall the service level agreement that we talked about last year with Zimasco that we did with Caminhos de Ferro de Moçambique (CFM) of Mozambique. We then followed it up with another service level agreement with container logistics companies for imports of containers into the country. As we talk, we are working with DRC Railways, Zambia Railways, NRZ, BBR and Transnet of South Africa for a co-ordinated approach to traffic that is emanating from the DRC and going all the way to Durban. For this, we have also partnered Nepad Business Foundation because not only are we looking at the marketing aspect, but we would also want to look at the corridor in terms of identifying the bottlenecks and take a co-ordinated approach to dealing with infrastructure bottlenecks that are on that corridor.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

We also want to pool the resources, the locomotives and the wagons so that we then put them together and we just give one train service to the customer from the DRC to Durban in less than 10 days and that way, we think we will be able to market and compete. So those are some of the initiatives we are taking in the short-term to try and recover our market share. And, of course, we are also trying to align our service delivery standards because, currently, we have different standards. Mozambique, they are Portuguese-based, Zimbabwe is English-based and so forth. So we are trying to harmonise our standards. We have got sub-committees within Sara that work on this.

We have also been looking at our regional training school. Some of us like NRZ and South Africa, have got training schools for training staff and we are trying then to harmonise our training so that in future, it would be easy for staff to interchange even if you want to run trains across the region, they will now share the same standards. We are trying to enhance safety. Through the committees, we have done a number of policy safety documents that are dotted regionally. These are actually then accredited to Sadc and they are recognised in Sadc so that we then follow the same standards. So, as Sara president, I’m trying to utilise, as you know, as Zimbabwe, we are strategically located. We participate in most of the corridors. So, as Sara president coming from Zimbabwe, I’m in a position that I’m able to participate in most of the corridors on the various initiatives. So I will try to maximise that opportunity so that we push all these initiatives.

ND: You touched this a little bit, how did you lose the market share to heavy trucks and what are you planning to do as an association to regain it?

LM: I think I touched a bit on it, but to go further, it was two-pronged. On the one hand, the road transport sector, our major competitor, developed on two aspects — first government generally were prioritising development in road infrastructure, they were investing in road infrastructure at the expense of rail.

And then also if you look at the road sector, the road rigs because of cheap second-hand trucks that people could buy from Europe, it became too easy for people to go to that business. So the equipment became easily available. So we saw a rapid growth for road transport equipment and with that, they were able to compete, yet for the railways, they were still utilising the equipment that was bought in the 1950s. So we were not really able to compete. But I must say that of late, governments have started realising that this is not a sustainable strategy. They needed to balance because there are many advantages of rail. For example, one train with one driver with one locomotive can pull the same cargo as 30 trucks with 30 drivers and lorries. So, in terms of pollution, we have got 30 lorries and in terms of employment or costs, we have got 30 drivers against one driver. In terms of infrastructure, those countries that have rehabilitated their roads have realised that those roads would have been damaged.

ND: What is the current state of the rail industry in Southern Africa?

LM: I think, generally, it’s still in poor state. You will find that going across the countries outside South Africa, at least South Africa has managed to invest and maintain its infrastructure, but for most of the railways, the infrastructure is really in a very poor state.

The track itself, the signalling is still quite poor, there is a lot of investment that still needs to go into rail infrastructure. In terms of equipment also, a lot of the equipment was bought in the 1960s, but I must say we have seen the involvement of the private sector in some of the areas. There’s quite a number of companies that own their own locomotives and are leasing to us, the railways throughout the region.

So, this has, to some extent, assisted in the investment in the overall railway industry. So the private sector is coming in buying locomotives, wagons and leasing them to the railways. At least in the short-term, the railways don’t have to spend a lot of money. So we think with time, the involvement of the private sector in mobilising finance, even if they don’t own the railways, but at least make the finances available, will assist the railways to recover.

ND: Roughly, how much do the railways in the region need for infrastructural development?

LM: I wouldn’t have the figures now, but talking of Zimbabwe for the National Railways of Zimbabwe infrastructure, we are talking of about $1,7 billion.

ND: What other major challenges does the sector face?

LM: There has been the challenge of infrastructure, the challenge of equipment and, of course, the investment then in the railways sector is a bit tricky because the returns tend to come over a long period. Unlike other sectors like telecoms, you will find that when you look for investors, even in Zimbabwe as we try to attract investors, it’s quite easy for people to go into telecoms because the returns tend to be very fast, but for railways, you have to invest a lot and the business cycle goes up and down.

ND: Are there rail expansion projects currently underway across Southern Africa? If so, what are some of those projects?

LM: There is a number of projects that are going on, as I said governments are looking at the railway industry and doing some investments. Like Zambia, you know there is Kazungula Bridge, where they are looking at linking Botswana and Zambia. Swaziland, they are developing a heavy wall railway line that can carry long trains like 100 wagon trains, 200 wagon trains together with South Africa to link up with the South African ports … DRC, they are looking at linking up in Angola through the Bengola line. Again, Zambia is also looking at linking up with Angola for the Lobito Port through a development of the Chingole Corridor that will link up with Angola.

Ourselves as NRZ, we are looking for a link from Harare to Zambia through Lions Den-Kafue. We jointly, with Zambia, floated a tender for a study to be done and, as we talk right now, we are adjudicating on the tender for a study that will do the feasibility and then the design of the line. Once that is done, we can now look for investors because we are already having the design. We are looking at linking up between Harare through Shamva, going towards Mutoko to Mozambique so that we can link with the port in Nanakala. We are working on the request for a proposal document and then we will be linking up with Mozambique so that we do it jointly. So those are some of the projects that we are working on in the region to link up some of the missing gaps.

ND: There has been a lot of vandalism of the railway infrastructure, particularly the signalling and communication infrastructure. How best are you going to deal with that issue?

LM: Certainly, there has been a lot of vandalism and the challenge has been that this equipment was made of copper and it was spread along the track throughout the system. So the presence of copper became very attractive for thieves and so on. The response that we are trying to develop is that we have been working on solutions that are centred around not having equipment on the ground. Here, we are trying to rely on satellite-based equipment and radio communication-based equipment, where you no longer have equipment that is distributed on the line. For example, for our locomotives, we have got our tracking systems, where we can track the position of our locomotives or trains using satellite technology, instead of the traditional signalling.

So we still need to develop that further into proper signalling in terms of controlling the movement of the trains. The next generation of trains, as we re-equip, will also be having on-board computers so that the driver, through a computer that is in the cab, can also control the movement of the train instead of relying on equipment on the ground. So the thrust is really to avoid as much of the equipment on the ground.