NETONE has entered into a partnership with BancEasy and First Mutual Life (FML) to roll out a facility to finance the buying of new smartphones and micro mobile insurance respectively as the country’s second largest mobile operator expands its footprint.

BY BUSINESS REPORTER

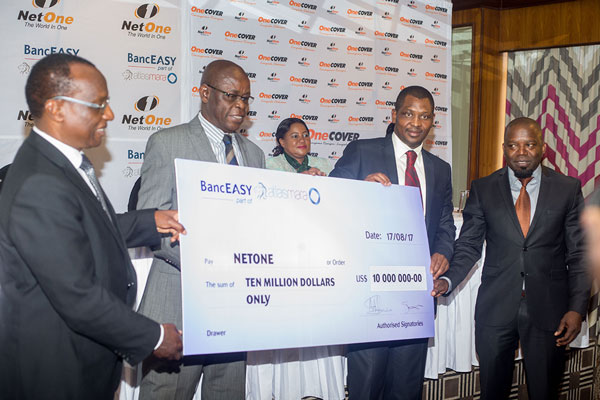

BancEasy, a unit of BancABC, will provide credit to subscribers to buy smartphones and then repay after 12 months. The product, OneTech, is financed to the tune of $10 million. Customers who access the facility will enjoy a year’s supply of OneFusion, NetOne’s integrated prepaid package.

Under OneCover, First Mutual Life will provide funeral cover to subscribers.

NetOne acting chief executive officer Brian Mutandiro said the two products which were launched yesterday in Harare would transform the lives of Zimbabweans.

Under OneTech, NetOne customers have an option to choose from a variety of smartphones from reputable international brands like Apple, Samsung, Huawei, Nokia, Alcatel, ZTE and Lenovo.

Commenting on the OneCover, Mutandiro said OneCover was a micro mobile insurance that will offer funeral insurance to subscribers and was underwritten by First Mutual Life. OneCover becomes a very competitive product in the market with premiums for 40 cents per month giving one a cover of $500. With additional premiums, one gets up to $3 000 worth of cover. It also covers senior citizens up to 84 years of age.

“Our other exciting product, OneCover, is an affordable micro mobile insurance that offers funeral insurance to our subscribers. This product offer is underwritten by First Mutual Life, that is the reason we are together today,” he said.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

Mutandiro said OneCover seeks to drive inclusion through affordable plans, easy access, leveraging on the reputation and the market share of NetOne Cellular.

He said the mobile operator was working everyday on “how to sharpen our arsenal”.

“We are sharpening our arsenal and coming back and say let’s increase our product base,” Mutandiro said.

BancEasy chairman James Wadi said the partnership with NetOne would help in the financial inclusion drive.

“This will help to make inroads and serve those who are not served,” he said. Wadi said the microfinancier wanted to meet the ever changing needs of its customers in a fast-paced environment.

He said the challenge facing service providers was how to tap into the informal market.

Wadi said the $10 million facility was a “major statement that we are making in an environment where Zimbabwe is going through some challenging times”.

FML chief operating officer Peter Shonhiwa said the partnership would result in FML widening its distribution channels.

“NetOne has the platform and FML has exciting products that people want,” he said.