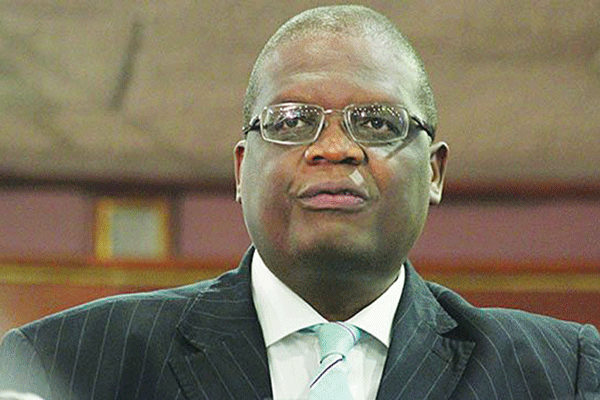

ON Monday, we carried a story in which Reserve Bank of Zimbabwe (RBZ) deputy governor Kupukile Mlambo indicated that the apex bank is working on a study on what accounts for the high spreads (mismatch between lending and deposit rates) and interrogate the cost build-up to the spread.

Comment: NewsDay Editor

He said one won’t be surprised to know that the biggest chunk of that spread was operational costs of banks.

The central bank deputy indicated part of reasons why the charges are high in Zimbabwe is because the financial services sector needs to pay those tellers salaries and bank managers.

But when one looks at the individual amounts that are being paid to tellers and to other staff, they are not that high.

According to Mlambo, the mismatch came from top management costs through cars, the security at their houses, salaries and school fees for children at South African universities, which constituted the bulk of the operational costs.

Yet at other banks, only the head of the institution was entitled to a car and the rest would get car loans.

We have no doubt that Mlambo was speaking out of experience given he was the director for East Africa at his former employers then, a third level because the structure has a president, vice-president and directors.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

Hence, the only thing that a director gets is a fuel subsidy, not allowance. We applaud Mlambo for the insights more so in an era in which executives continue to enjoy mega salaries and perks notwithstanding the fact that their organisations are underperforming.

We believe the high salaries and huge perks of bank executives are evidenced in the high lending rates and bank charges and low deposit rates that continue to turn away people from the banks. These high charges and lending rates are used to finance the high salaries and benefits for bank staff at the expense of depositors.

It is regrettable that depositors have borne the brunt of uninspiring deposit rates which disincentivise one to put money in a bank. Clearly, failure to put a stop to this rot means the drive to encourage people to put their monies in banks would be an exercise in futility.

However, it is our contention that the restructuring of the benefits regime should be spread to government corridors and the private sector.

Cabinet ministers and other top government officials are living large in an environment they expect everyone else to tighten their belts and be patient as a turnaround, which is obviously a mirage, is on the horizon.

They continue to cruise in fuel guzzlers that belie the harsh economic environment gripping the nation.

In 2013, the nation woke up to revelations of mega salaries among executives in State-owned entities or quasi-government companies. The mega salaries came at a time service delivery had plumbed to an all-time low.

In the private sector, executives continue living large. Companies listed on the Zimbabwe Stock Exchange are yet to disclose the salaries and benefits of their executives like what is happening in other markets throughout the world.

What the listed firms have managed to do is lumping together the benefits of executives without stating clearly what each executive gets. That disclosure brings transparency and accountability and brings the best out of executives as they will be under pressure to defend their salaries.

Until that has been done, Zimbabwe will continue moaning about mega salaries of executives financed by extortionate pricing of goods and services and poor service delivery.