SYDNEY — The United States dollar crept nearer to 14-year peaks yesterday, as an abundance of upbeat global economic data boosted Wall Street and signs of quickening inflation dented fixed-income debt.

Reuters

Spreadbetters pointed to a firm opening for European bourses, while E-Mini futures for the S&P 500 added another 0,1%.

The strength of the US currency kept a lid on commodity prices, but helped Japan’s exporter-heavy stock market rally toward its biggest daily increase in almost two months.

In its first trading day of the year, the Nikkei climbed 2,50% and looked set for the highest finish since December 2015. It was further aided by domestic data showing factory activity had expanded at the fastest pace in a year.

MSCI’s broadest index of Asia-Pacific stocks outside Japan was on track for a seventh straight session of gains, with shares up 0,2%.

The brightening mood followed a round of upbeat factory surveys from China, the euro zone and US. Analysts at Barclays said their measure of global manufacturing confidence hit its highest since December 2013.

US factory activity sped to a two-year high amid a surge in new orders, while manufacturing in the euro zone grew at its fastest pace in five years.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

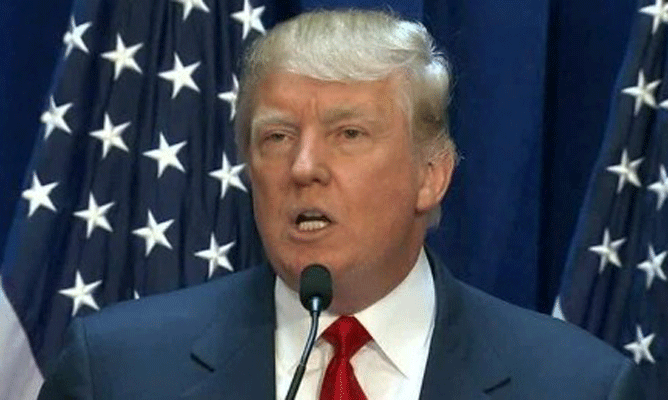

Notably, the US ISM showed a sharp pick-up in raw material prices, which stoked speculation stimulus measures proposed by US President-elect Donald Trump could generate more inflation.

Wall Street’s rally was further aided by gains in Verizon Communications and technology companies Alphabet and Facebook. The Dow ended on Tuesday up 0,6%, while the S&P 500 gained 0,85% and the Nasdaq 0,85%.

Ford Motor jumped 3,79% on news it would cancel a planned $1,6 billion factory in Mexico and invest $700 million at a Michigan factory, after Trump harshly criticised the Mexico investment plan.

The same news slugged the Mexican peso, leaving it at its lowest-ever close against the US dollar.

The dollar’s strength was broad-based and it hit a 14-year peak on a basket of currencies at 103.82 before profit-taking pulled it back a touch to 103.32.

After an early pause on the yen, the US currency edged up to 118.11 and back toward major chart resistance around 118.60/66. A floundering euro was pinned at $1,0402, having dived as deep as $1,0342 overnight.

The euro’s decline came despite a jump in domestic bond yields after data showed German inflation hit its highest level in more than three years in December.

While much of the increase was due to transitory factors such as energy, long-term inflation expectations still rose to their highest since December 2015.

Overall euro zone numbers, due later yesterday, were expected to show inflation picked up to an annual 1%, from 0,6% previously.

German 10-year bond yields leaped 10 basis points to a two-week high of 0,29%.

In commodity markets, oil prices steadied after losing more than 2% on Tuesday. US crude clawed back 40 cents to stand at $52,73 a barrel, while Brent futures added 43 cents to $55,90.