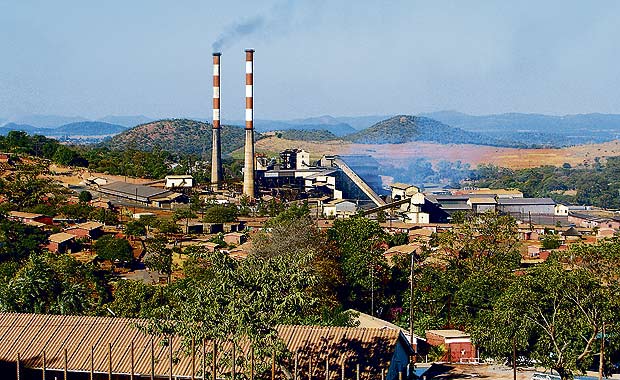

LISTED mining concern, Bindura Nickel Corporation (BNC), has said it is registering progress on its capital projects despite facing funding constraints.

BY VICTORIA MTOMBA

BNC chairman, Yim Chiu Kwan said the project to re-deepen a shaft was adversely affected by funding constraints, which was exacerbated by unfavourable nickel prices during the period.

Expenditure to date on the shaft re-deepening project is $13,9 million.

“An estimated additional $5,1m is expected to be spent before completion of the project. Commissioning is targeted to take place in the year ending March 2019,” he said.

“On the smelter restart project, cashflows have caused delays in meeting some payment obligations. However, committed expenditure to date is $19,5m. Project progress has reached 71% of the completion target.”

BNC posted profit-after-tax of $1,2m for the half year ended September 2016, compared to a loss of $3,4m in the same period last year, due to an increase in production.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

During the period under review, the company sold 3 464 tonnes of nickel concentrate compared to 2 762t in the comparative period last year.

Kwan said a 25% increase in tonnes sold translated to a 9% increase in revenue to $22,4m compared to $20,6m in the prior year.

“The improved performance was anchored on a 23% increase in production to 3 420t in the half year ended September 30, 2016, compared to 2 791t in the previous year,” he said.

“This achievement was possible in spite of the 19% decrease in the average nickel price received for the period to $6 198 per tonne in the previous (half year September 30, 2015: $7 654 per tonne).”

The cost management initiatives culminated in a 22% decrease in cost of sales to $14,3m versus $18,3m recorded in the comparative period last year, while cash costs decreased by 34% to $5 216 per tonne compared to $7 864 per tonne the prior year.

During the period under review, the mine milled 205 290 tonnes of ore, a slump from last year’s 231 224 tonnes.