Zimbabwe’s tentative return to its own currency is getting a hostile reception from citizens, who fear a recurrence of the 500-billion percent inflation that plagued the southern African nation before it abandoned its dollar seven years ago.

M&G Africa

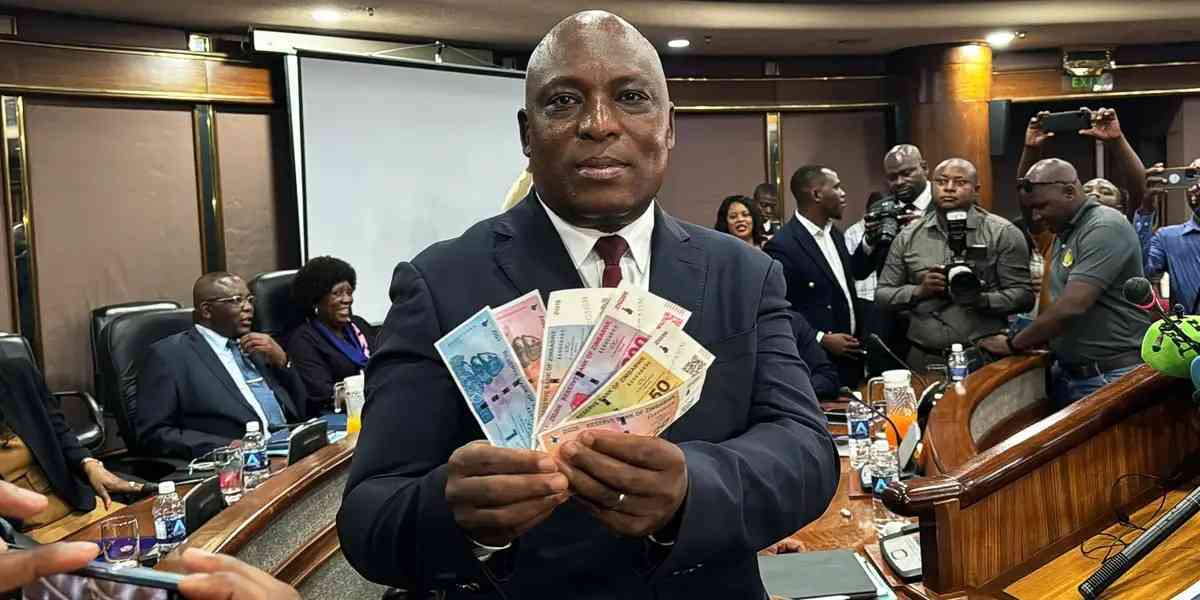

The country will soon introduce so-called bond notes, pegged to parity with the United States dollar and beginning with denominations of $2 and $5 notes, Reserve Bank of Zimbabwe (RBZ) governor John Mangudya said last week.

It’s an attempt to complement the range of foreign currencies used in the beleaguered economy since 2009, which have been in short supply following a collapse in exports.

James Sakupwanya, who sells items such as maize meal, tinned food and blankets from his shop in Mutare, southeast of Harare, isn’t buying it.

Sakupwanya and Zimbabweans like him see the notes as a step back to the hated Zimbabwean dollar, which by the time of its demise was valued at 150 trillion to the greenback, according to the central bank.

“We will reject it,” Sakupwanya said.

“They can legislate as much as they want, but it is their currency that they want to impose on us to manage the crisis they created.”

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

An earlier announcement of plans to introduce the currency sparked riots in Harare even after the government said the notes, which will be legal tender only in Zimbabwe, will be backed by a $200-million loan from a multilateral lender.

Banks have limited cash withdrawals to prevent hoarding of dollars, used in 95% of all transactions in the country, and some shops reported they’re running short of essential goods.

Zimbabwe has been gripped by a liquidity crisis that’s forced the government to pay its workers late in recent months.

Finance minister Patrick Chinamasa said on September 9 that the State may cut 25 000 civil service jobs as it struggles to meet pay obligations. Zimbabwe owes lenders including the World Bank and Africa Development Bank about $9 billion, according to the Finance ministry.

In addition to the US dollar, Zimbabwe also uses eight other currencies, including the South African rand, euro, British pound and Chinese yuan.

Getting Zimbabweans to adopt the bond notes will be difficult, given fresh memories of a worthless currency, Mangudya and Zimbabwe Revenue Authority board chairperson, Willia Bonyongwe, have said.

“If people don’t want bond notes, they don’t have to accept them,” Mangudya told business leaders in early October, and Bonyongwe said in an e-mailed statement that the expected arrival of bond notes had caused “uncertainty in the economy” and led to people hoarding dollars.

The bond notes won’t address structural challenges facing the economy, said Naome Chakanya, an economist with the Labour and Economic Research Institute, a Harare-based think-tank.

The economy collapsed in the wake of a campaign to seize white-owned commercial farms and hand them over to black subsistence farmers, triggering a near decade-long recession, as exports from tobacco to roses slumped.

About three million of Zimbabwe’s 13 million people still live abroad after fleeing the economic crisis, according to the United Nations.

Employment in the manufacturing sector has dropped to 85 000 from 200 000 in 2009, according to the Confederation of Zimbabwe Industries, and 4 600 companies have closed down in the past three years, according to RBZ data.

“Some are going to accept it, some are going to reject it, others will be frog-marched to accept since the cash crisis is worsening,” Chakanya said.

“There is a high probability of emergence of a black market for US dollars, thus, creating more problems for the economy” including inflation.

Adding to the suspicion is uncertainty about who exactly will lend Zimbabwe the money to back the bond notes. Gift Simwaka, the African Export-Import Bank’s regional manager for southern Africa, declined to confirm whether the notes will be underwritten by the multi-lateral lender.

Without a hard-cash foundation, the notes will be no different to so-called bearer cheques, a temporary currency with denominations of as much as 100 trillion Zimbabwean dollars introduced at the height of hyperinflation in 2008, Sakupwanya said.

“They are forgetting that in 2008 we rejected their bearer cheques, so what stops us from rejecting their bond notes,” he said.