BOLD policy action combined with a speedy re-engagement process are some of the measures Zimbabwe can adopt in addressing structural impediments, the International Monetary Fund (IMF) has said.

BY FIDELITY MHLANGA

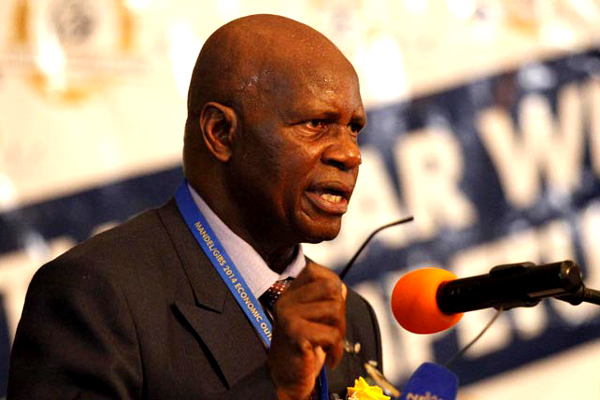

Speaking at the Zimbabwe National Chamber of Commerce annual congress, IMF resident representative Christian Beddies said there was need for immediate policy action to restore confidence.

“Bold policy action combined with fast-tracking re-engagement with the international community, and the finalisation of the economic transformation programme, including an ambitious macro-economic programme for the next three years will assist in addressing the structural impediments,” he said.

Beddies said market accessibility and distribution, overhead costs and telecommunications infrastructure were affecting investment decisions and were not a high priority at the moment in Zimbabwe.

He said investors were also concerned about the overhead cost and bureaucracy, tax arrears and how to deal with forex challenges and liquidity constraints.

Beddies said there is need for policy consistency and transparency, clear taxation policies, and co-ordinate charges and permits review.

Zimbabwe is re-engaging international financial institutions to tap into cheap lines of credit needed to reboot the economy.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

A team from IMF was in the country last month to discuss the current economic situation and solutions.

Zimbabwe has an external debt of over $10 billion which has militated chances of accessing cheap lines of credit. The country has presented term sheets on how it would clear its combined $1,8 billion debt to the three preferred creditors — IMF, World Bank and the African Development Bank.

Clearing the debt would be the first step in the country’s plans to liquidate its total external debt.

According to an arrears and debt clearance plan presented on the sidelines of the IMF/World Bank annual meeting last year, Zimbabwe said it would get a bridging loan facility arranged by its debt advisers, the African Export-Import Bank, to clear its outstanding arrears to AfDB ($585 million) and African Development Fund ($16 million).

The loan would be repaid using inflows from the Fragile State Facility of the African Development Bank. The second phase entailed using government’s Special Drawing Rights holdings to clear the $110 million owed to IMF.

Zimbabwe said it would use a medium-to-long-term loan to clear its $1,1 billion arrears to the World Bank Group. It said the loan would have a tenure of 10 to 15 years at an interest rate of 5-7% per annum. It would be repaid as a bullet payment, that is, the entire loan plus interest will be payable at the end of the loan tenure.