THE Reserve Bank of Zimbabwe (RBZ) has put in place stringent prudential measures to plug illicit financial flows, as it emerged that close to $2 billion was spirited out of the country last year by individuals and companies, worsening the liquidity situation.

BY NDAMU SANDU

The new measures include, among others, getting rid of the concept of free funds, reporting of suspicious transactions and use of plastic money. A customer who wants to withdraw above $10 000 will now be required, with effect from today, to give the bank reasonable notice of at least a day.

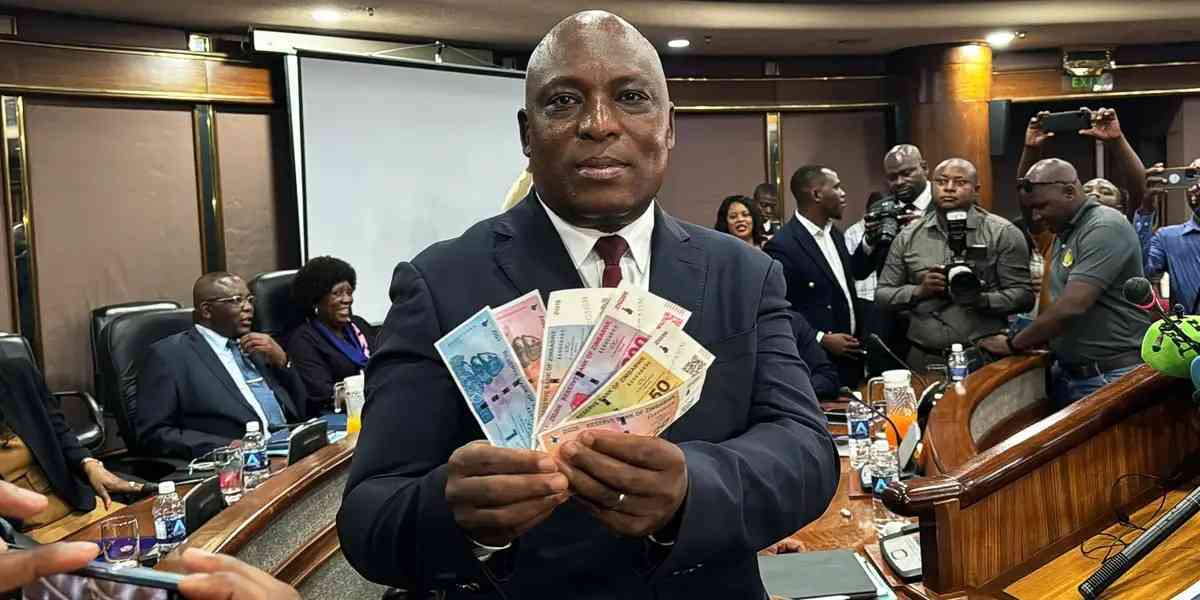

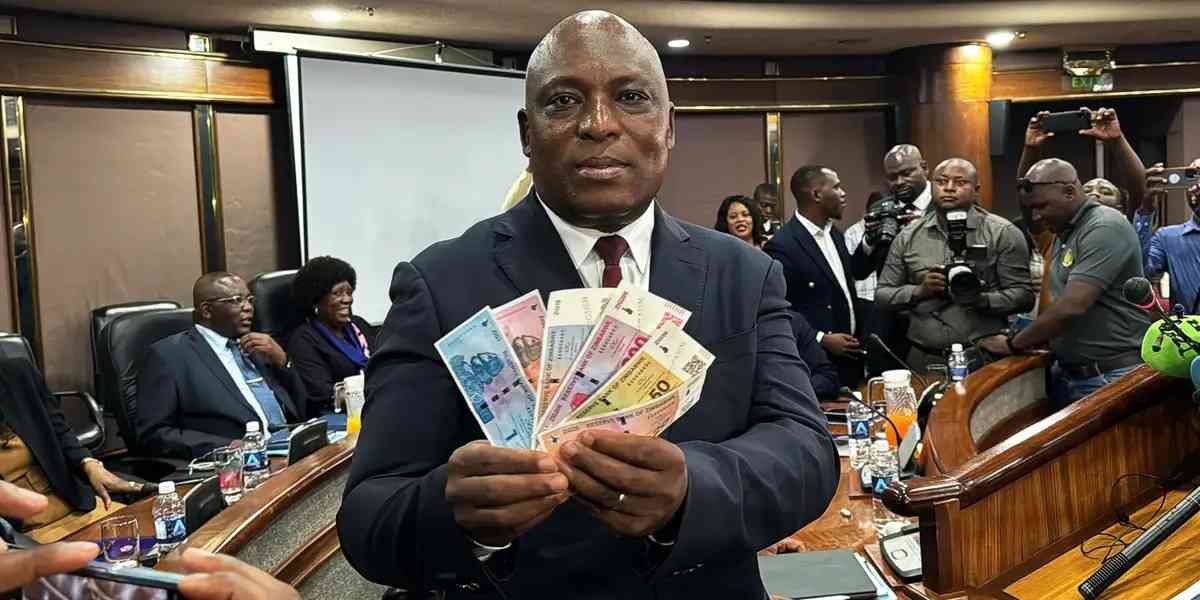

In his monetary policy statement delivered yesterday, RBZ governor John Mangudya said money was flowing out of the country dwindling the liquidity position of the economy.

He said $864 million was externalised in 2015 by individuals under the auspices of free funds for various dubious and unwarranted purposes that included remittance of donations to oneself, offshore investments and externalisation of export sales proceeds by corporates through individual accounts leading to pervasive tax evasion and externalisation.

He said $1,2 billion was externalised by companies in the form of export proceeds, high management and expert fees.

“We are exporting liquidity. We need to put a stop to this behaviour. There is need for a fundamental shift to protect the integrity of the multicurrency system,” he said.

Mangudya said those in the habit of externalising funds have to stop warning “there will be too many skeletons and I won’t be able to bury them”.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

“Let’s draw a line in the sand and never cross it again,” he said.

Mangudya said banks have to report all suspicious transactions to RBZ before processing of the outgoing transactions.

He said the ex-post reporting system was not useful, as the country was continuously losing money.

Mangudya in jurisdictions such as the US, they have resorted to the management of currency or cash transactions by enforcing maximum reportable cash limits that can be carried on person or withdrawn from financial institutions to guard against money laundering.

He said an individual with authority or interest over one or more financial accounts or securities or investments in a foreign country should report, through normal banking channels, to RBZ if the aggregate value of such accounts or securities at any point in a calendar year exceeds $10 000. He said going forward, any offshore investments would require prior RBZ approval.

Mangudya said there has been an increase in service payments between related companies, especially holding companies and their subsidiaries or sister companies resulting in some corporates inflating service fees in order to externalise foreign currency.

To remedy the situation, Mangudya said service payments should not exceed an aggregate of 3% of revenue and now required RBZ approval.

Mangudya said any financial institutions found to be complicit by systematically turning a blind eye to any suspicious transactions or any of the prudential measures would be fined or penalised under the Money Laundering and Proceeds of Crime Act [Chapter 9:24].

Illicit financial flows occur in countries with weak legal and institutional frameworks. These outflows drain foreign exchange reserves, reduce tax revenues, cancel out investment inflows and worsen poverty.