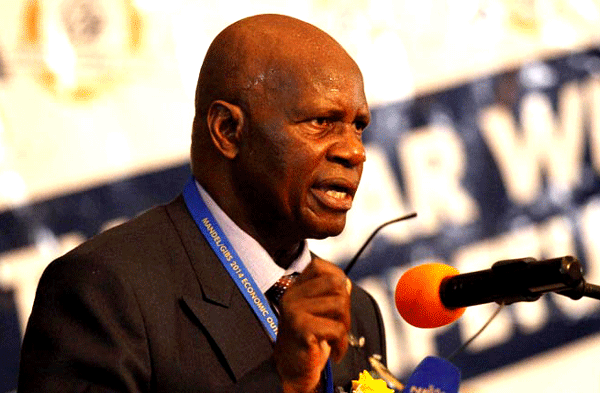

FINANCE minister Patrick Chinamasa has said the Banking Amendment Bill, which is in its second reading stage in the National Assembly, will address issues that threaten the stability of the financial services sector.

BY VENERANDA LANGA

He said the Bill will focus on amendments that are centered on instilling good corporate governance, good credit risk management practices, as well as consumer protection.

“Poor corporate governance has been identified as the major cause of most bank failures, and this is due to the fact that the quality of decisions and implementation of decisions affects the performance of banking institutions,” Chinamasa said on Tuesday.

“The Bill will require all banking institutions to comply with all good corporate governance requirements of the regulator before commencing operations on an ongoing basis. This will prevent banking institutions from operating if they have not instituted the requisite corporate governance systems.”

He said the Bill, if passed into law, will restrict the number of executive directors on the board. Non-executive directors of banking institutions will also be hindered from sitting on boards of more than five registered companies including a board of the banking institution on which the director sits.

Chinamasa said shareholding limits for individuals at banking institutions will be reduced from 25% to 10% of share capital. He said this was aimed at reducing the risks of banking failure arising from undue influence by individuals through an undiversified shareholding structure.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

“Shareholding limits for non-financial corporate entities shall be raised from 10% to 25% of share capital. The regulated financial entities will continue to establish wholly-owned banking institutions with the approval of the Registrar [of Banks],” he said.

“The level of significant shareholding to be approved by the Registrar will be 5% of share capital.”

Chinamasa said the Bill will also provide for the mandatory appointment of a compliance officer as a principal officer of a banking institution to enhance compliance structures.

It will also provide for credit rating of all banking institutions operating in Zimbabwe by a credit rating agency which will publish the ratings once a year, as well as empower the Reserve Bank of Zimbabwe to regulate the Credit Reference Bureau.

“The Bill proposes the establishment of Zimbabwe Asset Management Company to acquire illegible and collateralised non-performing loans in the banking sector to cleanse banks’ balance sheets of toxic assets, which have hampered the institutions’ underwriting capacities,” the Finance minister said.

The most important factor in the Bill, Chinamasa said, will be to minimise banking failures through enabling the regulator to act at an early stage to address unsafe and unsound practices or activities that would pose risks for banks.