Last week’s instalment chronicled the rise of the agent banking model and outlined some recent financial sector developments validating the model as a viable option for the delivery of financial services.

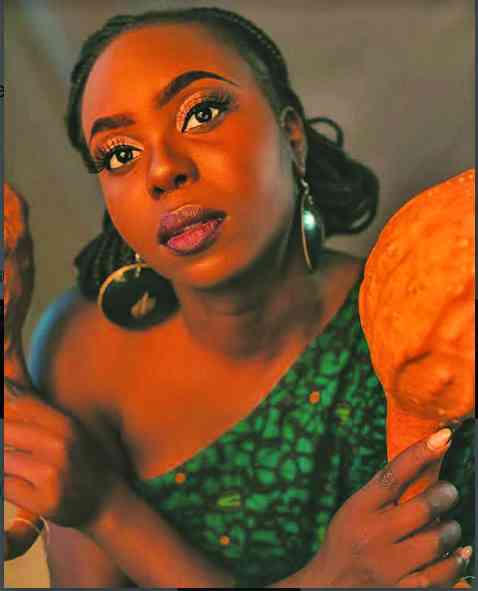

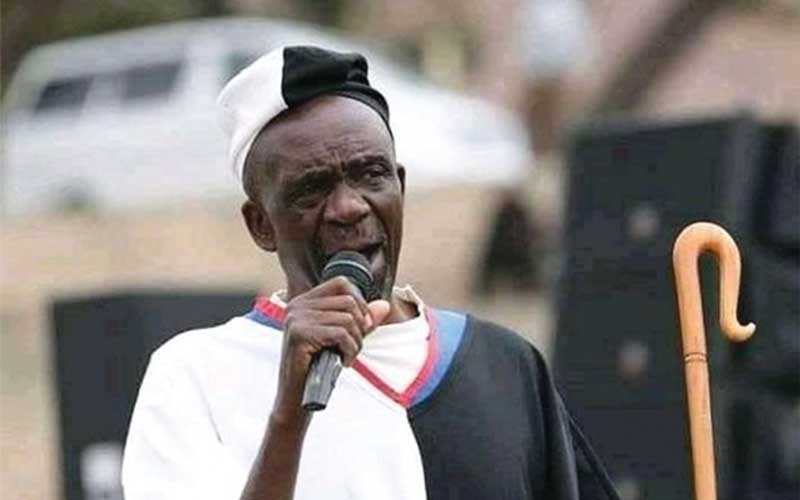

Omen Muza

This week we take a close look at the drivers of the agent banking model.

Supply-side fundamentals Increasing awareness and understanding of the agent banking model and its benefits means that more market players are ready to play the role of agents in order to diversify both their product offerings and revenue streams.

Inevitably, these agents are beginning to organise themselves in order speak with one strong voice in policymaking issues and benefit from economies of scale. One such result is the Mobile Money Transfer Agents’ Association of Zimbabwe (MMTAAZ) which already has hundreds of registered agents under its wings and continues to register new members.

MMTAAZ is currently scouting for partners and is seeking to establish links with organisations in need of the use of Mobile Money Agents for the purpose of delivering their services.

Business Model Realignment Changing technological dynamics have altered the way people communicate, resulting in the reduction in use of “snail mail” and fixed telephones or landlines in favour of SMS and mobile telephony respectively, to the extent that companies such as Zimpost and TelOne now have excess capacity which has forced them to reconfigure their business models in order to survive in the new normal.

Part of this realignment has seen them embracing agency services in order to ensure optimal usage of their real estate and human resources.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

Zimpost, for instance, is now in partnership with the likes of Champions Insurance (for Motor Insurance), FBC Bank (for FBC MasterCard cards), and POSB (for banking services) and also has agency arrangements with the likes of EcoCash, OneWallet and NettCash.

TelOne also has an agency arrangement with FBC Bank for FBC MasterCard cards.

Regulatory Oversight/Support The Reserve Bank has had to come to the party in order to promote agency banking, given the model’s potential to enhance financial inclusion because of its cost-effective nature.

In February 2014, the RBZ waded into the dispute between Econet and its agents and directed that no agent could be tied down to an exclusive agency arrangement without the Reserve Bank’s approval.

This regulatory move was seen as levelling the playing field and making it possible for agents to support multiple partners as long as they have the capacity to do so.

The regulator also signalled that it was geared to ensure that sanity prevails in a sector that holds much promise for financial inclusion, by deploying appropriate regulatory interventions when called for.

Closure of Brick-and-Mortar Bank Branches Increasingly, banks are unable to sustain some brick-and-mortar branches, particularly those in outlying areas, due to the fixed costs involved in running them yet they do not generate adequate volumes of business.

The resultant closure of these branches leaves large swathes of unbanked markets which present an opportunity for more sustainable models of delivering financial services. And agency is one of them because it leverages on existing infrastructure to provide financial services with minimal additional investment required.

Channel Diversification

While for some — such as ZB Bank which recently invited prospective agents to register with the bank — adoption of the agent banking model is a strategic imperative meant to diversify the available delivery channels.

ZB already has a reasonable nationwide footprint, but it just wants to increase the options.

For others such as IDBZ, for instance, the footprint is limited given that it is not essentially a retail bank, so for the delivery of its mortgage-based Home Saver Account, the bank has had to enter into agency arrangements with the likes of POSB and other undisclosed institutions in order to enhance its reach.

Availability of Infrastructural Options The availability of infrastructure that can be deployed for agency purposes is also a driver of the agency banking model. These options are epitomised by mobile phone technology which is helping providers of financial services (banking, insurance and microfinance) to unlock access to rural markets that were previously largely unbanked.

Steward Bank’s agent banking model, for instance, is based on EcoCash, Econet Wireless’ mobile banking platform, without which the bank would have had to start developing an agent network from scratch, which, of course, costs a pretty penny.

In your view, what other factors are driving the agent banking model? Feedback: [email protected]. Omen N Muza writes in his personal capacity. You can view his LinkedIn profile at zw.linkedin.com/pub/omen-n-muza/30/641/3b8