ZIMBABWE’S economy is expected to grow by a marginal 1,5% this year, a local research firm, MMC Capital, has said.

VICTORIA MTOMBA BUSINESS REPORTER

This is well below the 6,1% that the government had earlier on projected. It is also lower than the 3% growth that the World Bank had predicted.

“We, however, opine that the gross domestic product growth will slow down in 2014 to around 1,5% on the back of structural economic deficiencies,” MMC Capital said.

This comes as companies continue to close as the economy is experiencing deflationary pressures.

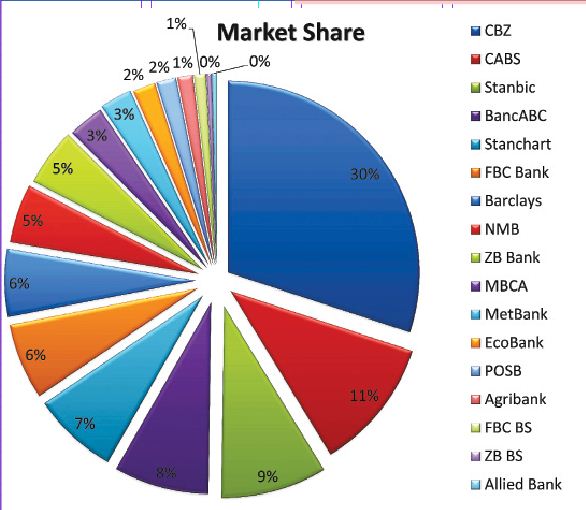

NOTE: To view figures for a particular bank, mouse over the pie piece that corresponds with the bank.

It is estimated that 10 000 people have been laid off since last year and more are expected to be retrenched as firms continue to shut down.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

In its Banking Survey for 2013, MMC Capital said the effects of the Memorandum of Understanding (MoU) between the Reserve Bank of Zimbabwe (RBZ) and banks which took effect in February last year got the better of banks as industry profitability deteriorated by 36,45% to $83,8 million.

“Worsening non-performing loans (NPLs) position continues to be an albatross around the banking sector’s neck and the result has been reduced lending to the economy which has further worsened the NPLs situation,” said MMC Capital.

“As the local economic activity slides further, our view is that industry NPL ratio will continue to rise as borrowers fail to repay. Reduced lending is disastrous to the economy as key productive sectors will be starved of working capital.”

The MoU was, however, scrapped in November last year.

The research firm said banks’ impairment charges increased by 70,91% to $71,44 million in 2013 which casts doubt over the quality asset creation in the country.

It added that CBZ and NMB banks contributed over half of the impairments during the period under review.

The research firm said total assets grew by 7% and the loans to deposit ratio also weakened to 78% (December 31 2013) from 92% (December 31 2012), reflecting a shift in the lending approach in line with the risky credit environment.

CBZ Bank has maintained a consistent dominance in the banking sector as evidenced by its leading position in the top quartile across the deposits, loans and advances and total assets genres since 2009. MCC Capital said the dominance of CBZ Holdings, however, was threatened by CABS and Stanbic.