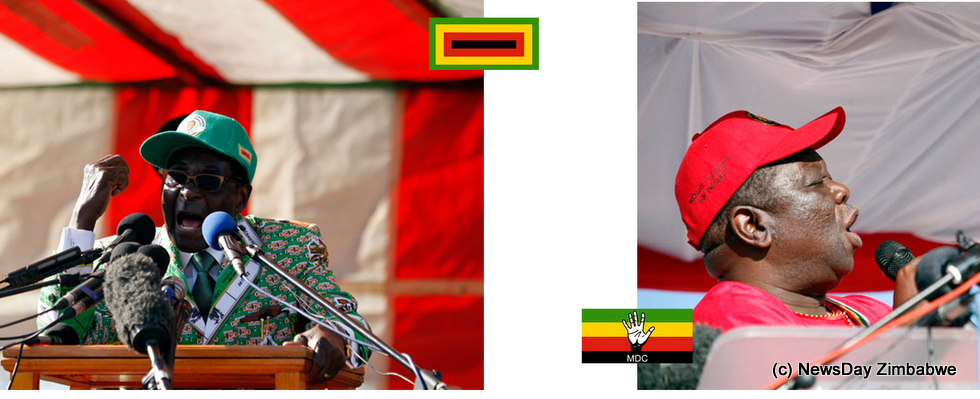

THE campaigns by different politicians ahead of the July 31 make-or-break elections have failed to convince the business community of a better Zimbabwe, indicating a vote of no confidence in the parties’ manifestos.

REPORTS BY REPORT BY BERNARD MPOFU /TARISAI MANDIZHA

One rallying point for the country’s business organisations is that another coalition government is not welcome. As it stands, the business community has failed to endorse the manifestos of the parties involved and can only bank on the outcome of the polls.

Political uncertainty, observers say, has been the biggest crippling factor in the resuscitation of Zimbabwe’s economy and elections must result in a single government that will usher in consistency in policy proclamations.

With just six days before Zimbabwe goes for polls, captains of industry and commerce seem to be keeping their cards close to their chests. The past few weeks have seen the country’s main political parties launching their election manifestos at a time when economic activity has slowed down.

For Zanu PF, the indigenisation and economic policy compelling foreign-owned companies to sell 51% stakes to locals is the key to stimulating economic growth.

The Morgan Tsvangirai-led MDC, on the other hand, envisages a $100 billion economy by 2018, anchored by foreign direct investment. The Welshman Ncube-led MDC sees devolution as a catalyst to economic growth.

The manufacturing sector, whose capacity utilisation last year plunged to 44% from 57% amid indications that it would further decline, is confronted by a myriad of problems.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

Problems besetting the economy include subdued foreign direct investment, limited long-term capital, general uncompetitiveness and a huge energy deficit.

Confederation of Zimbabwe Industry president Charles Msipa said Zimbabwe needed a government with policy clarity and a conducive economic environment.

“The country requires a clear, stable and consistent policy framework and an environment that addresses our economic opportunities and challenges. Whether that policy environment is delivered by a coalition or single-party government is for the electorate to decide,” Msipa said.

Official statistics show that over 100 companies have closed down during the past year with Bulawayo, once the country’s industrial hub, hardest hit. Zimbabwe’s economy, according to Finance minister Tendai Biti, contracted by 3% during the first quarter of the year as more companies continued to face viability problems.

Zimbabwe National Chamber of Commerce president Davison Norupiri said another coalition government was not conducive for economic growth in Zimbabwe.

“With the current situation or the current environment whereby we have a coalition government, it has been so difficult for the government to make decisions and pass decisions because of this Government of National Unity (GNU). People were coming from different backgrounds, different political parties, and so as a result, some of the decisions were not tallying,” Norupiri said.

“We strongly believe that we no longer need anything of this nature. We no longer need a Government of National Unity, because it takes us as a nation maybe five or 10 years back. From the time we got into the GNU, we haven’t moved much in terms of economic development and as a result, it’s something that is regrettable and I don’t think any business community will be happy with such a creature again.”

He said the chamber contended that a one-party government reduces policy inconsistencies and political intransigence within government. Zimbabwe Energy Council executive director Panganayi Sithole said Zimbabwe should not have a coalition government as this didn’t do much for the development of power generation in Zimbabwe.

“The Zimbabwe Energy Council is not keen to have another forced coalition. This coalition managed to stabilise the economy only.

There was no real growth, and neither new business birthed during the life of the coalition government,” Sithole said. He said although the main political players were keen on tackling the energy crisis affecting the economy, none of the parties was clear on how energy projects could be financed.

Questions sent to the Bankers’ Association of Zimbabwe and the Chamber of Mines of Zimbabwe were not responded to at the time of going to print.

Zimbabwe is currently battling with a $10,7 billion debt which has been an albatross around the neck of the government.

Zanu PF says it has plans to add 1 750 megawatts (MW) from the new projects and 1 520MW from the rehabilitated existing power stations, while the MDC-T promises to bring on board 6 000MW by 2018.

Zimbabwe, which currently has a daily energy demand of 2 200MW, is generating an average of 1 500MW and importing 150MW daily.

According to the Zimbabwe Energy Regulatory Authority Cost of Service Study on electricity supply which was completed in April this year, Zimbabwe’s electricity generation is expected to improve in 2017 after the completion of expansion works at Hwange Thermal Power Station.

According to the report, the power situation was expected to ease within four years due to increased capacity at Hwange.

A post-election case scenario.

UNIVERSITY of Zimbabwe Graduate School of Management head Professor Tony Hawkins recently told delegates attending the IHS Economic Outlook Conference in South Africa that another coalition government after the July 31 elections is not good for the economy. The conduct and outcome of presidential and parliamentary elections within the next few weeks, Hawkins said, would drive short-term economic performance. He said three elections may emerge out of what many say would be watershed polls. Below are excerpts from his presentation:

- Worst case — Another coalition

- Months of political wrangling over new coalition agreement

- Political uncertainty entrenches

- Policy uncertainty deepens and

- Most investors — not all — foreign and local, sit on their hands

- International lending and development agencies limit engagement

- Economy stagnates, poverty and unemployment worsen and social unrest mounts 5

Base case — Another five years of Zanu PF Short-term uncertainty over:

- International reaction and responses, and who succeeds President Robert Mugabe and when?

- Intra-party faction fighting intensifies

- Policymaking paralysed — exchanging current uncertainty for a different type

- Militants push hard for indigenisation, more State ownership and limited engagement with donors and Bretton Woods institutions

- Focus on “Look East” policy — China, Russia, India

Best case — MDC-T wins overall majority

- Greater economic policy rationality — extreme economic policies diluted or dropped

- Closer engagement with international community at all levels

- Focus on strengthening institutions especially rule of law, free media

- Focus on foreign capital, especially for infrastructure but also foreign direct investment generally

- Focus on job creation and poverty reduction

MDC DOWNSIDES

- Disappointing track record since 2009 — blamed (partly rightly) on dysfunctional coalition

- Leadership lacks credibility — perceived as indecisive and prone to policy U-turns.

- No reversal of land reform nor indigenisation — omelettes (land) cannot be unscrambled.

- No political, popular support for efforts to revert to past agricultural models, meaning change will be evolutionary.

- Strong popular support for sensibly-managed indigenisation.

OUTCOMES In a country with no opinion polling and a possibility — some would say certainty — of intimidation and vote-rigging — no sane person, let alone economist, would dream of trying to call the outcome. For what it is worth, the conventional wisdom is that it will come down to the turnout.

A low turnout favours Zanu PF and a high one – especially if the MDC-T can get the youth vote out – favours Morgan Tsvangirai.

- As an economist, I cannot imagine how voters who lived through hyperinflation and the 10-year Mugabe meltdown could give his party yet another chance, especially given the uncertainty surrounding the succession.

- Despite the MDC-T’s disappointing track record, the election is theirs to win, always remembering that they may not be allowed to do so if the dark arts of vote-rigging and intimidation prevail. Outright MDC-T victory sets the stage for annual growth in the region of 6% yearly.

Economy, biggest loser — MMC Capital

MMC Capital Research, a local brokerage and advisory firm, in its recently released quarterly market review says Zimbabwe requires consistent policies to grow the economy. The country boasts of the second largest platinum reserves and a high literacy rate, but remains one of the poorest in the world. Below are excerpts from the report. Downside risks on the rise

The Zimbabwe economy’s three-year strong growth run is slowly losing steam as liquidity challenges experienced in the first half of the year choked most of the economic growth engines.

Official estimates put GDP growth rate at 5% which was being rumoured to be revised downwards by Treasury as downside risks heightened. We are of the opinion that the projection was a bit optimistic given constraints such as the liquidity crunch and low foreign direct investments because of political uncertainty as well as indigenisation fears. We, however, expect a positive growth of 3,5% which will still be 100bps above the World Bank’s 2,5% projection Politics, an albatross around the economy’s neck

Political uncertainty heightened in the quarter amid chaos in the constitution-making process and conflicting calls on the elections. Although political grandstanding remained prevalent, there seemed to be a genuine realisation by political leaders that political dithering would not benefit the economy.

The GNU agreed to hold elections on July 31 in the third-quarter though the dates were contested, hence investors were given clarity as to what would take place and when.

The economy was the biggest loser though in all the bickering that took place as capital avoided the real sectors of the economy and chose the more liquid investments which are short term in nature. Foreign portfolio flows were positive though below the previous three years’ levels.

Indigenising a capital-dehydrated economy

The path to elections resulted in populist policies being given prominence, chief among which was the indigenisation policy. In the quarter under review, the banking sector was the biggest loser as threats to indigenise the sector’s biggest players left the economy in a compromised position as credit supply was depressed. Cash budgeting struggling to live up to its name

In dealing with the macroeconomic instability, Zimbabwe adopted a cash budgeting system to manage prevailing revenue uncertainty. Revenue volatility has remained relatively high, while government expenditure remained skewed towards consumptive programmes.

Capital expenditure is still the biggest casualty as the government wage bill gobbled up more than two-thirds of total revenues. There is need to promote consumption and aggregate demand to prop up economic growth through lower taxes.

The current account and BOPs

Performance of exports during the first half of 2013 was generally not pleasing, as exports declined compared to the same period in 2012. Total exports from January to April were $1,02 billion, which is a decrease of about 1,2% compared to the same period in 2012.

The dismal performance of exports was more pronounced in March 2013, where exports fell by about 18% compared to their value in March 2012. Import performance during Q1 2013 did not help in reducing the balance of trade deficit.

While exports were falling, imports during the first quarter of 2013 increased by about 4,4% to $2,63 billion compared to the same period in 2012. This increase was largely spurred by the increase in imports in January and March 2013, when the value of imports was higher than the values registered in 2012.

Imports remained biased towards consumption products and this in turn fuelled the liquidity challenges as most of these funds were technically externalised out of the economy. The widening trade deficit increased the nation’s short-term debt resulting in deteriorating country fundamentals.