No independence joy for civil servants

By Blessed Mhlanga

Apr. 19, 2024

CSOs call for reforms on Independence Day

By Priveledge Gumbodete and BRENT SHAMU

Apr. 19, 2024

.

Videos

Pamela Marwisa In Conversation With Trevor

By The NewsDay

Feb. 28, 2024

By The NewsDay

Feb. 28, 2024

By The NewsDay

Dec. 5, 2023

Old Mutual launches funeral services in Masvingo

Sponsored Content

Vintage travel and tours reveals its successes

Sponsored Content

EcoCash extends payroll services to security companies

Sponsored Content

Study rules out human factor in southern Africa drought

President Emerson Mnangagwa is seeking US$2 billion from the international community to avert food shortages after declaring the drought a state of disaster.

By Nhau Mangirazi

6h ago

Demand for milk seen softening

By Mthandazo Nyoni

Apr. 18, 2024

Govt sets target for winter wheat production

By Priviledge Gumbodete

Apr. 17, 2024

El Niño drives Zimbabwean millers to seek Brazilian corn

By Bloomberg News

Apr. 16, 2024

High rabbit pellets prices choke Zimbabwe farmers

By Mthandazo Nyoni

Apr. 5, 2024

Tobacco firm BAT hires new MD

By Blessed Ndlovu

Apr. 4, 2024

Govt sets target for winter wheat cropping

By Harriet Chikandiwa

Mar. 30, 2024

Uhuru at 44: Still a long way out

By Newsday

Apr. 18, 2024

No room for politicking in food distribution

By Newsday

Apr. 17, 2024

Bullying tactics will not work

By Newsday

Apr. 16, 2024

ZiG: Guard against political interference

By Newsday

Apr. 15, 2024

Availability will stabilise sugar prices

By Newsday

Apr. 13, 2024

Govt considered cryptocurrency to deal with currency crisis…as Mushayavanhu reveals ZiG creation

Mushayavanhu said he was in September last year told that he was going to be governor and began consultations.

By Tatira Zwinoira

Apr. 19, 2024

Zim firms optimistic of clinching deals at Agritech Expo

By Mthandazo Nyoni

Apr. 19, 2024

Shot in the arm for the Deeds Registry

By Business Reporter

Apr. 18, 2024

Mind your pricing regime, HAZ warns operators

By Freeman Makopa

Apr. 17, 2024

Old Mutual thumbs up new MPS measures

By Melody Chikono

Apr. 17, 2024

Access to credit by women improves

By Mthandazo Nyoni

Apr. 17, 2024

It won’t be business as usual, RBZ boss tells staff

By Mthandazo Nyoni

Apr. 17, 2024

Premier seeks US$3,74 million for Zulu project

By Mthandazo Nyoni

Apr. 16, 2024

.

Sport

.

Opinion

NewsDay cartoon 28 November, 2023 edition

NewsDay cartoon 28 November, 2023 edition

By The Watcher

Nov. 28, 2023

Govt urges unity among lithium miners

Currently there are around eight different lithium exploration and mining projects at different development stages.

By Mthandazo Nyoni

Jun. 1, 2023

Over 130 civilians killed by DR Congo rebels - UN

By BBC News

Dec. 8, 2022

Opaque Chinese deals: Mthuli taken to task

By admin

Aug. 29, 2022

Power outages, raw material shortages hit ART operations

By The NewsDay

Aug. 17, 2022

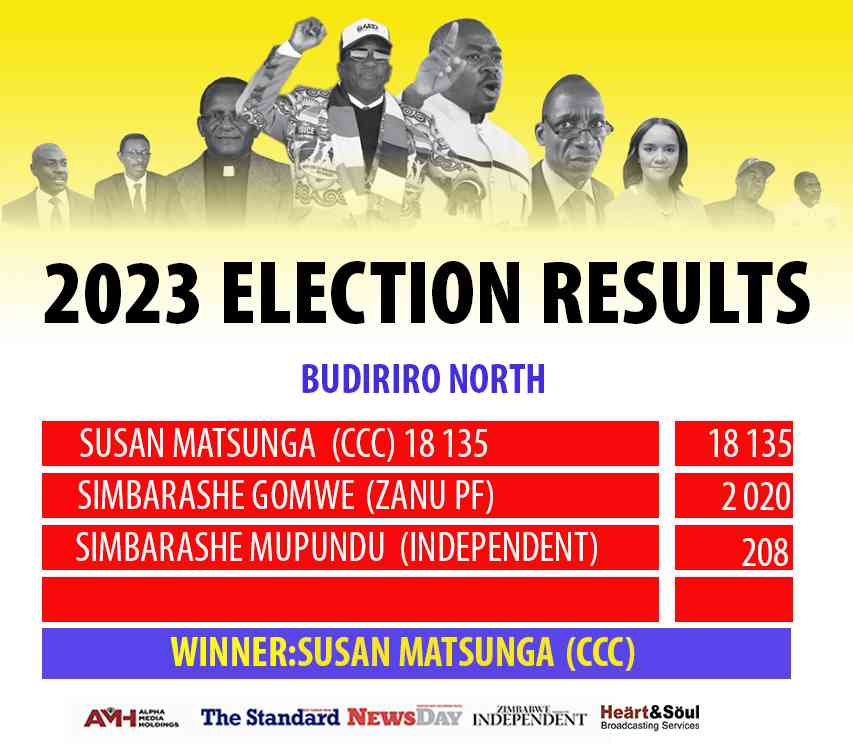

We’re unstoppable: CCC

By The NewsDay

Aug. 16, 2022

Umzingwane, Matobo main road ‘forgotten’

Matobo ward 15 councillor Dickson Moyo said the Old Gwanda road, which is major road passing through Umzingane and Matobo, had been neglected for more than five years.

By The NewsDay

Jul. 29, 2022

Diasporas must vote in Zim elections

The Zimbabwe Diaspora Vote Initiative closely followed the Russian elections, monitoring how the Russian government handled diaspora voting in that election.

By AMH Voices

Apr. 6, 2024

Lady Chevrons vie for World Cup place

By AUSTIN KARONGA

Apr. 14, 2024

Youth move in to get slice of construction industry cake

Chihota gave thumbs up to the parent association, ZBCA, for coming up with such an initiative.

By Staff Reporter

Apr. 14, 2024

Makarati boost for DeMbare

By Henry Mhara

Apr. 14, 2024

Scores arrested for booing Auxillia

By KUMBIRAI MAFUNDA and Everson Mushava

Apr. 14, 2024

Champions Ngezi Platinum snatch point from Bosso

By Munyaradzi Madzokere

Apr. 14, 2024

Govt fails to pay civil servants for blitz

By Miriam Mangwaya

Apr. 14, 2024

12 in court for human trafficking

It is reported that the accused confessed that they were taking the children to South Africa.

By Silas Nkala

6h ago

Zim duo jailed in Botswana

By Silas Nkala

6h ago

Cancer patient sends SOS.

By JERSSIE MPOFU

6h ago

Govt urged to walk the talk on Byo water crisis

By Patricia Sibanda

Apr. 19, 2024

Farmers lose livestock to harmful mining practices

By Rex Mphisa

Apr. 19, 2024

De Souza banks on speed, agility.

Zimbabwe U20 rugby team head coach, Shaun De Souza is happy with the team’s preparations and looking forward to their tournament opener against Tunisia.

By AUSTIN KARONGA

20h ago