.

Videos

Pamela Marwisa In Conversation With Trevor

By The NewsDay

Feb. 28, 2024

By The NewsDay

Feb. 28, 2024

By The NewsDay

Dec. 5, 2023

Old Mutual launches funeral services in Masvingo

Sponsored Content

Vintage travel and tours reveals its successes

Sponsored Content

EcoCash extends payroll services to security companies

Sponsored Content

Govt to clamp down on cotton side marketers

Farmers are owed US$3,2 million by the country’s largest cotton producer, Cottco Holdings Limited (Cottco).

By Blessed Ndlovu

Apr. 11, 2024

High rabbit pellets prices choke Zimbabwe farmers

By Mthandazo Nyoni

Apr. 5, 2024

Tobacco firm BAT hires new MD

By Blessed Ndlovu

Apr. 4, 2024

Govt sets target for winter wheat cropping

By Harriet Chikandiwa

Mar. 30, 2024

Smart farming to fight El Nino

By Nhau Mangirazi

Mar. 30, 2024

Farmers urged to prioritise soil testing

By BELINDA CHIROODZA and ROPAFADZO MAKOSI

Mar. 21, 2024

Chiwenga calls for fairness in tobacco trading

By Melody Chikono

Mar. 14, 2024

TSL to beef up units

By Blessed Ndlovu

Mar. 14, 2024

Availability will stabilise sugar prices

By Newsday

Apr. 13, 2024

Moral suasion key for currency survival

By Newsday

Apr. 12, 2024

Kwibuka 30: Lessons for Zim

By Newsday

Apr. 11, 2024

Govt must not undermine new currency

By Newsday

Apr. 10, 2024

ED must rein in third term movers

By Newsday

Apr. 9, 2024

‘Zim needs to accelerate ICT penetration’

By Melody Chikono

Apr. 15, 2024

Mineral exports hit US$20b mark

By Blessed Ndlovu

Apr. 15, 2024

Byo industries urged to support central bank new measures

By JERSSIE MPOFU

Apr. 15, 2024

Fresh push to deepen Africa, Caribbean ties

By Ndamu Sandu

Apr. 14, 2024

Business in ZiG thumbs down…adopts wait-and-see attitude

By Melody Chikono

Apr. 12, 2024

.

Sport

.

Opinion

NewsDay cartoon 28 November, 2023 edition

NewsDay cartoon 28 November, 2023 edition

By The Watcher

Nov. 28, 2023

Govt urges unity among lithium miners

Currently there are around eight different lithium exploration and mining projects at different development stages.

By Mthandazo Nyoni

Jun. 1, 2023

Over 130 civilians killed by DR Congo rebels - UN

By BBC News

Dec. 8, 2022

Opaque Chinese deals: Mthuli taken to task

By admin

Aug. 29, 2022

Power outages, raw material shortages hit ART operations

By The NewsDay

Aug. 17, 2022

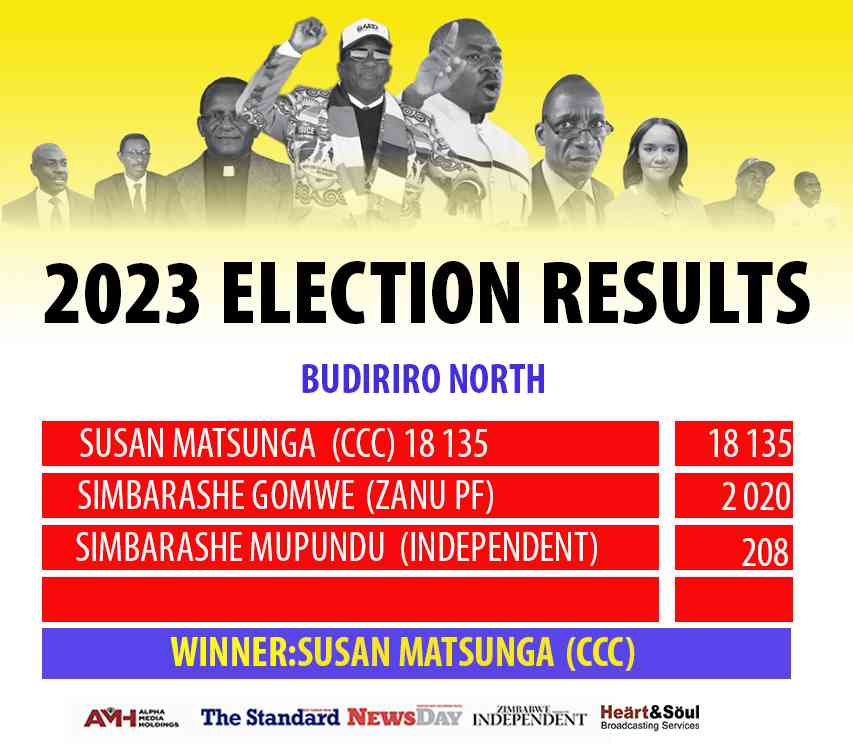

We’re unstoppable: CCC

By The NewsDay

Aug. 16, 2022

Umzingwane, Matobo main road ‘forgotten’

Matobo ward 15 councillor Dickson Moyo said the Old Gwanda road, which is major road passing through Umzingane and Matobo, had been neglected for more than five years.

By The NewsDay

Jul. 29, 2022

Diasporas must vote in Zim elections

The Zimbabwe Diaspora Vote Initiative closely followed the Russian elections, monitoring how the Russian government handled diaspora voting in that election.

By AMH Voices

Apr. 6, 2024

InnBucks pours US$5 million into operations

InnBucks has determined the functional currency as the United States dollar.

By Tatira Zwinoira

Apr. 14, 2024

RBZ snubs forex auction bidders

By MELODY CHIKONO

Apr. 14, 2024

GhettoDances: Gossip only breeds confusion and enmity

By Onie Ndoro

Apr. 14, 2024

Govt invests US$13m in early warning systems

By Melody Chikono

Apr. 14, 2024

Out & About: The hum incubating Kehlani’s scales

By Grant Moyo

Apr. 14, 2024

BCC rakes in thousands in fines

By Silas Nkala

5h ago

CCC Bulawayo meets after Chamisa’s departure

The other co-president, Tendai Biti, has since quit opposition politics under unclear circumstances saying he intended to take a sabbatical.

By Nizbert Moyo

5h ago

Byo housing scammer nabbed

By Nizbert Moyo

Apr. 15, 2024

Pumula residents, Chinese miner clash over noise

By Innocent Magondo and Patricia Sibanda

Apr. 15, 2024

Zebra meat lands Binga man in trouble

By DANIEL MOYO

Apr. 15, 2024

Forex Brokers with 1 USD Minimum Deposit in Tanzania

In terms of trading accounts, there are four different accounts that traders can choose from. These include the standard account, the micro account

By Theindependent

Apr. 13, 2024

By Cynthia Tapera

Apr. 12, 2024